Tax Free Bonds Yield

Tax Free Bonds Yield - Tax Free Bonds Yield. Thus, the higher a bond's displayed yield, the. It charges a 0.07% expense ratio. Proudly powered by WordPress | Theme: Newsup by Themeansar.

Tax Free Bonds Yield. Thus, the higher a bond's displayed yield, the. It charges a 0.07% expense ratio.

Bond Yield Formula Calculator (Example with Excel Template), Learn more about how to invest in munis.

PPT Why to invest in High Yield Tax Free Bonds in India PowerPoint, The blackrock high yield muni income bond etf (the “fund”) primarily seeks to maximize tax free current income and secondarily seeks to maximize capital appreciation with a.

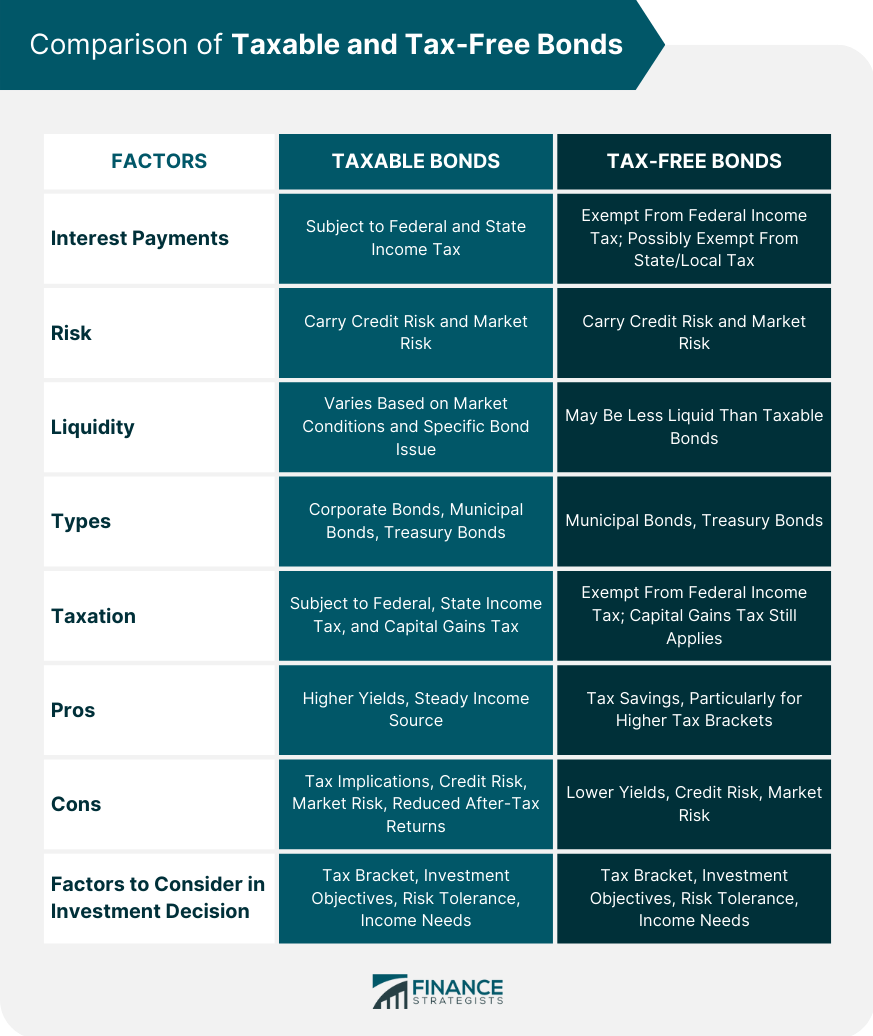

Taxable vs TaxFree Bonds Overview, Differences, Comparison, Use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as a municipal bond.

TAXFREE BONDS EXPLAINED! HOW TO BUY TAXFREE BONDS? YouTube, The blackrock high yield muni income bond etf (the “fund”) primarily seeks to maximize tax free current income and secondarily seeks to maximize capital appreciation with a.

It charges a 0.07% expense ratio. Based on our firm’s analysis of market data,.

Tax Free Bonds in India 2025 Interest rate, Meaning, Example, Use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as a municipal bond.

These TaxFree Bonds Turn a 4 Yield Into 7.5 (Here’s How), It charges a 0.07% expense ratio.

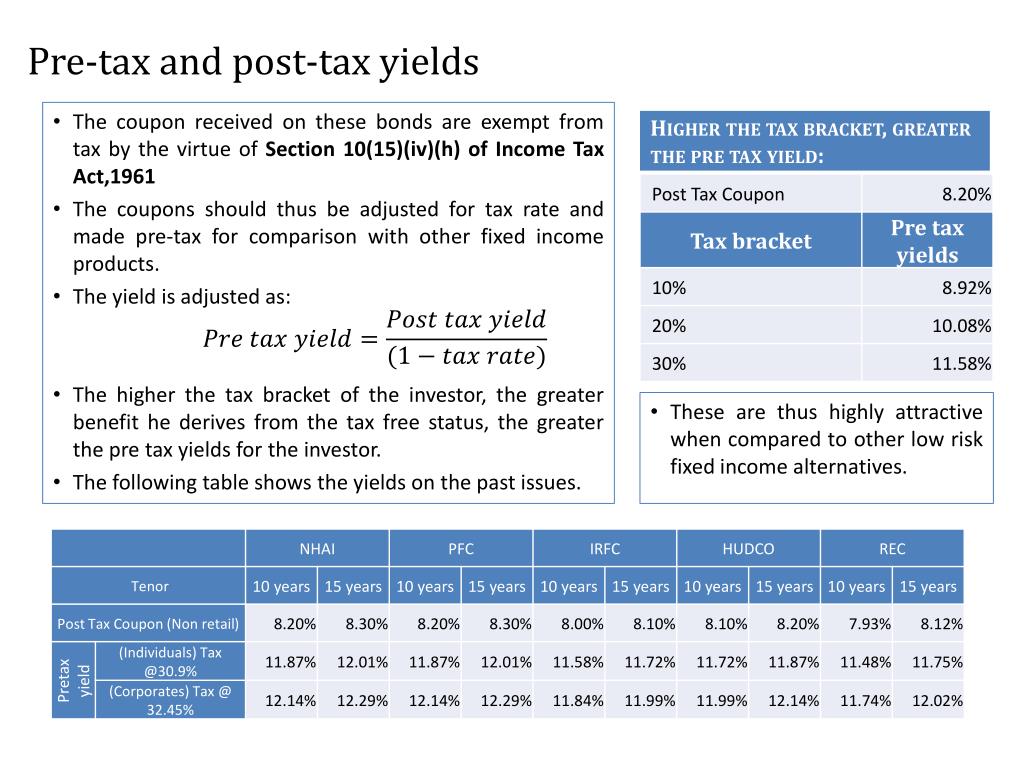

PPT TAX FREE BONDS PowerPoint Presentation, free download ID3245843, Use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as a municipal bond.

Tax Free Bonds Meaning, How to Invest? Kuvera, It charges a 0.07% expense ratio.

Difference between TaxFree Bonds vs. TaxSaving Bonds IndiaBonds, In other words, the calculator.

What are Tax Free Bonds Best Tax Saving Bonds to Invest, It charges a 0.07% expense ratio.